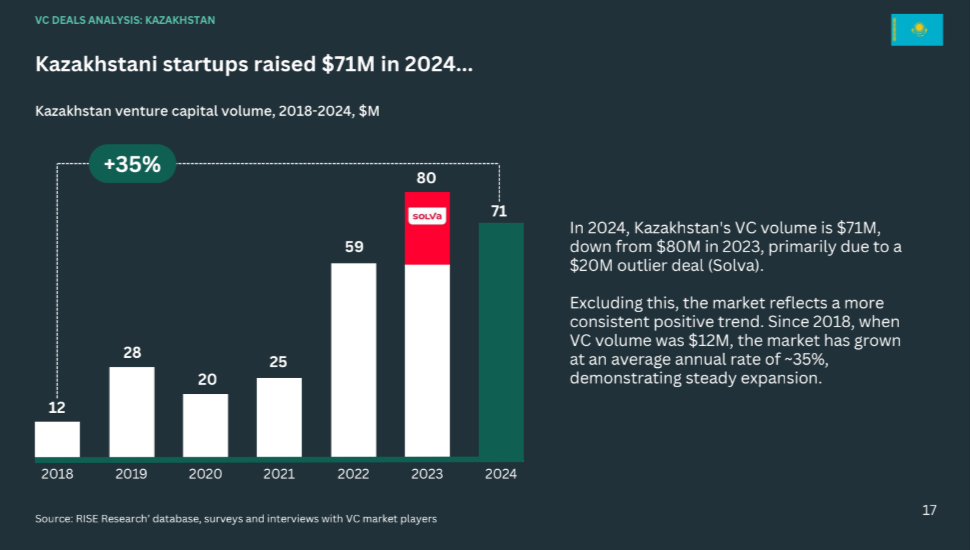

Kazakhstan continues to strengthen its position as the main venture hub in Central Asia. The volume of venture capital investments in the country reached $71 million, accounting for 74% of all VC deals in the region.

ALMATY, KAZAKHSTAN – March 19, 2025 – RISE Research, in collaboration with EA Group Holding, MA7 Ventures, BGlobal Ventures (a subsidiary of Qazaqstan Investment Corporation), KPMG, and Dealroom.co, conducted a large-scale study of Central Asia’s venture capital market for 2024. The study involved over 200 startups and 40 venture investors and market experts.

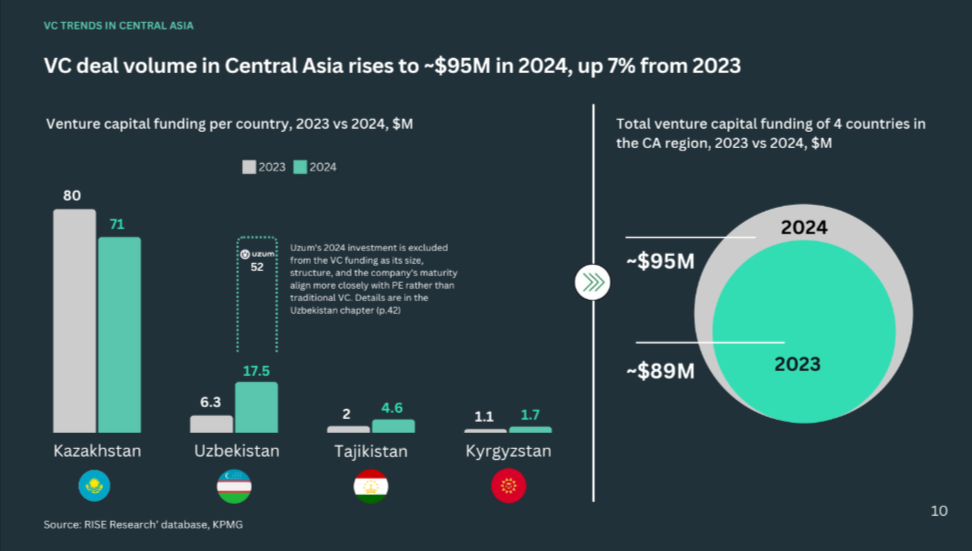

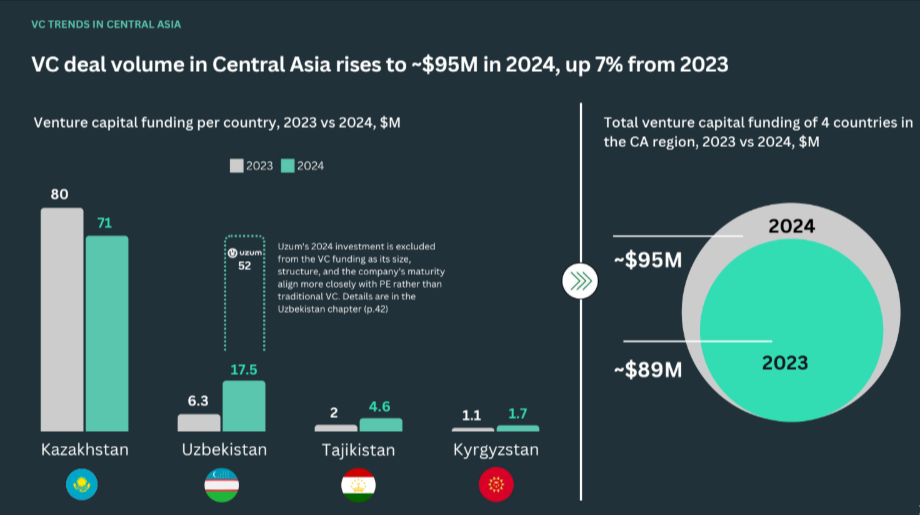

According to the findings, Central Asia’s venture market continues to grow. The total amount of venture deals in the region in 2024 reached $95 million, a 7% increase compared to 2023.

ALMATY, KAZAKHSTAN – March 19, 2025 – RISE Research, in collaboration with EA Group Holding, MA7 Ventures, BGlobal Ventures (a subsidiary of Qazaqstan Investment Corporation), KPMG, and Dealroom.co, conducted a large-scale study of Central Asia’s venture capital market for 2024. The study involved over 200 startups and 40 venture investors and market experts.

According to the findings, Central Asia’s venture market continues to grow. The total amount of venture deals in the region in 2024 reached $95 million, a 7% increase compared to 2023.

Kazakhstan retains its leadership and remains the most active VC market in Central Asia, accounting for 74% of total investments in the region. In 2024, Kazakhstani startups raised $71 million, with an average annual investment growth rate of 35% since 2018.

“The venture capital market in Central Asia, especially in Kazakhstan, is developing rapidly. More startups are entering global markets, and international investors are recognizing the region’s potential. At MA7 Ventures, we not only invest but also create the conditions for startup growth and international expansion, supporting founders and investors in strengthening the region’s position on the global map,”

— said Murat Abdrakhmanov, founder of MA7 Ventures.

The number of active investors tripled to over 60 participants, indicating a growing interest in the country's startup ecosystem. Over 80 venture deals were recorded in just one year.

“True success in the venture market isn’t just about the number of deals—it's about startups scaling and establishing themselves globally. Kazakhstan has already proven itself as an innovation driver in the region, and our next goal is to help startups become global players. At EA Group, we support game-changing projects and help startups from Central Asia enter European markets,”

— said Yerik Aubakirov, CEO of EA Group.

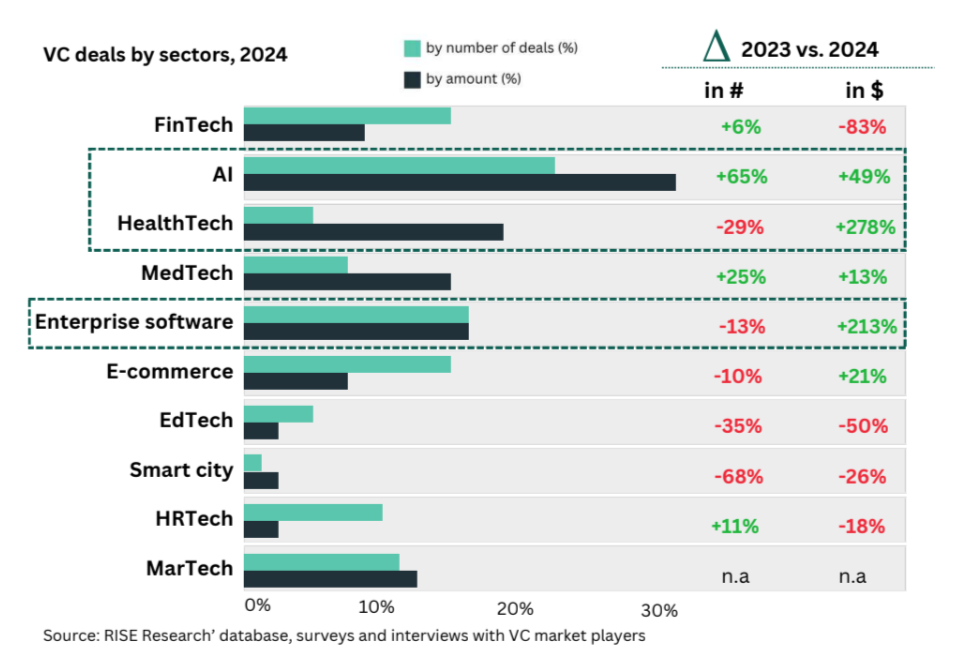

Particularly dynamic growth has been observed in sectors such as Artificial Intelligence (AI), HealthTech, and Enterprise Software. Many AI startups are not officially classified under AI since they integrate AI technologies into financial, medical, and other solutions—meaning the actual impact of AI is even greater than current data suggests.

— said Murat Abdrakhmanov, founder of MA7 Ventures.

The number of active investors tripled to over 60 participants, indicating a growing interest in the country's startup ecosystem. Over 80 venture deals were recorded in just one year.

“True success in the venture market isn’t just about the number of deals—it's about startups scaling and establishing themselves globally. Kazakhstan has already proven itself as an innovation driver in the region, and our next goal is to help startups become global players. At EA Group, we support game-changing projects and help startups from Central Asia enter European markets,”

— said Yerik Aubakirov, CEO of EA Group.

Particularly dynamic growth has been observed in sectors such as Artificial Intelligence (AI), HealthTech, and Enterprise Software. Many AI startups are not officially classified under AI since they integrate AI technologies into financial, medical, and other solutions—meaning the actual impact of AI is even greater than current data suggests.

“This report shows that Central Asia is becoming an important player on the global VC map. At MA7 Angels Club, investors vote with their money for the technologies being built in our region, backing startups that are already shaping the future,”

— noted Yelzhan Kushekbayev, business angel and CEO of MA7 Angels Club.

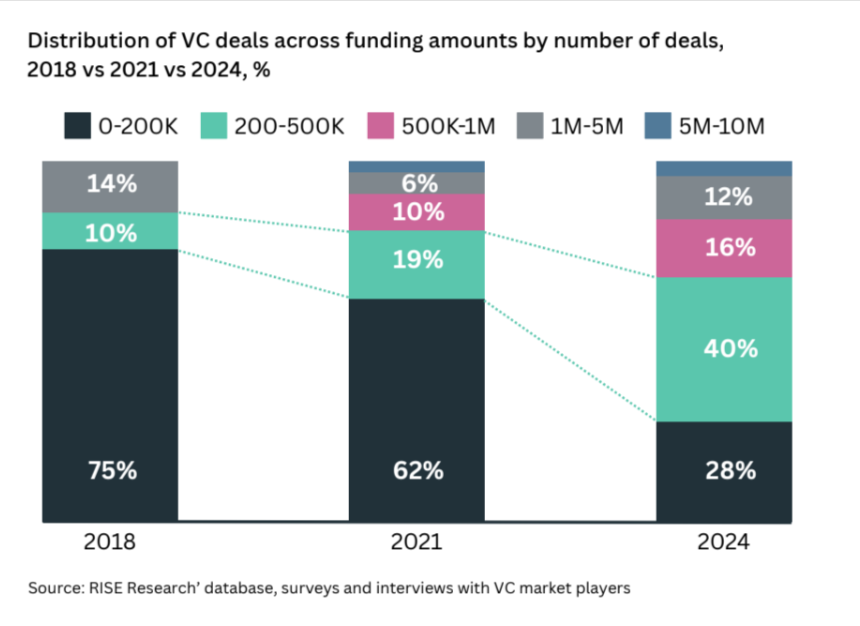

The market is also showing growth in average deal sizes, reflecting increased attractiveness of Kazakhstani startups to investors. SAFE agreements dominate early-stage deals (pre-seed and seed), accounting for 63%, simplifying the capital raising process.

— noted Yelzhan Kushekbayev, business angel and CEO of MA7 Angels Club.

The market is also showing growth in average deal sizes, reflecting increased attractiveness of Kazakhstani startups to investors. SAFE agreements dominate early-stage deals (pre-seed and seed), accounting for 63%, simplifying the capital raising process.

“Kazakhstan’s venture capital market is showing confident growth: average ticket sizes are increasing, startups are becoming more mature and capable of attracting and effectively using international capital. BGlobal Ventures actively supports the ecosystem through educational initiatives and funding efforts. We believe Kazakhstan is ready to become a launchpad for regional projects on the global stage,”

— said Nurzhan Kadirkey, CEO of BGlobal Ventures.

In 2024, the total assets under management of 12 Kazakhstani VC funds exceeded $157 million, with 32% already invested in startups. 44% of VC funding came from private investors (high-net-worth individuals), but upcoming state-backed initiatives—particularly the fund of funds—could significantly reshape funding sources as early as 2025.

It is also worth noting that Kazakhstani startups have become more active in entering international markets in 2024, including the U.S., Europe, the Middle East, and Southeast Asia. These trends are increasing average check sizes and company valuations, potentially paving the way for Kazakhstan’s first unicorn startup.

— said Nurzhan Kadirkey, CEO of BGlobal Ventures.

In 2024, the total assets under management of 12 Kazakhstani VC funds exceeded $157 million, with 32% already invested in startups. 44% of VC funding came from private investors (high-net-worth individuals), but upcoming state-backed initiatives—particularly the fund of funds—could significantly reshape funding sources as early as 2025.

It is also worth noting that Kazakhstani startups have become more active in entering international markets in 2024, including the U.S., Europe, the Middle East, and Southeast Asia. These trends are increasing average check sizes and company valuations, potentially paving the way for Kazakhstan’s first unicorn startup.